Keep eyes on economic growth figures if you want to trade Bond CFDs

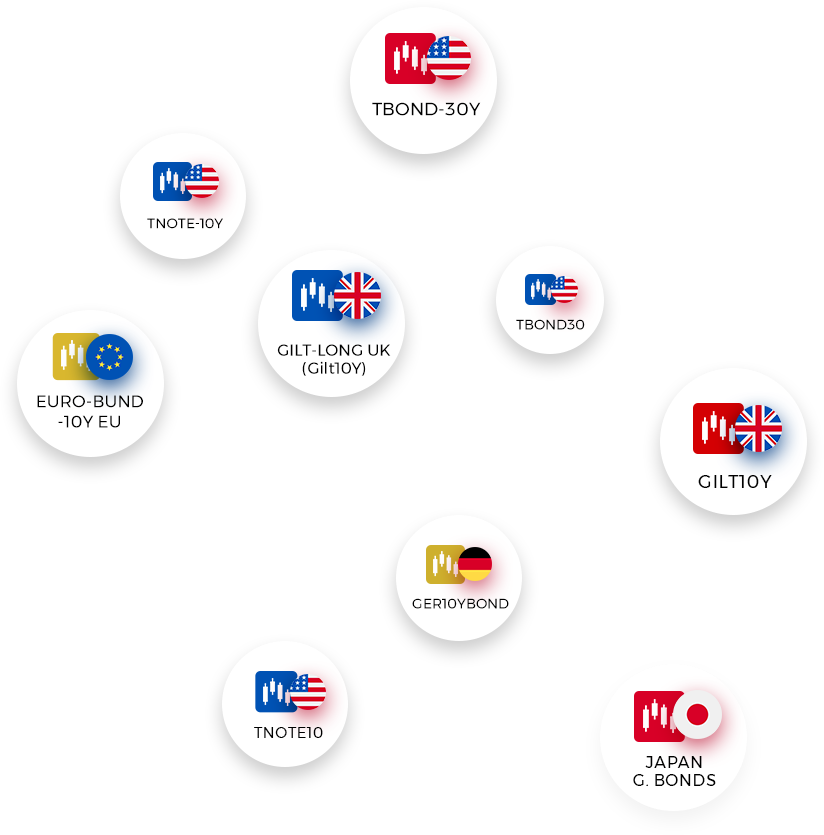

You can trade on the Bond market on WebTrader and MT4 platforms 24 hours, 5 days a week. We selected 5 of the most well-known sterling, yen, euro & dollar bonds, all available as CFDs.

Now it’s time to watch the fundamental data closely as this is the true motivator of Bond prices. The better the economy does, the more chance the country has to repay, demand goes up as does the price.

Click here to view a complete list of current overnight rollovers.

Asset Search

Start Trading Bonds

Bonds are bought and sold every day by investors, with the value totally dependent on the ability of the original issuing government to repay.

Asset Trends

Use Finq Traders’ Trend tools to assess how many traders are buying and selling in real-time to optimize entry points and manage risk according to market sentiment.